As we approach the anniversary of the Consumer Duty regulations, it’s worth reflecting on how they’ve shaken up the financial services industry. These rules have raised the bar for consumer protection, pushing businesses to put their customers’ needs front and centre. But let’s be honest – if you’re only now scrambling to meet these standards, you’ve been missing the point somewhat! Great customer outcomes shouldn’t just be a regulatory box to tick; they should be the heartbeat of your business.

The 2023 Consumer Duty was a wake-up call, a chance to inject some real purpose into your company and inspire change. And this is not a ‘once and done’ process but an ongoing journey. In this article, we’ll share some practical tips on communication best practices and how to continually monitor your customer outcomes to stay ahead of the game.

What we will cover:

1. A checklist for customer-first communications

2. How to monitor Consumer Duty outcomes as a marketer?

3. Final thoughts

A checklist for customer-first communications

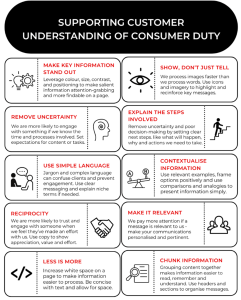

A year into the Consumer Duty regulations, marketers will have had time to review their customer touchpoints and identify potential areas for negative customer outcomes. However, to ensure customer-centric communications remain top of mind, we’ve provided the following Consumer Duty checklist, inspired by behavioural psychology best practices:

Leveraging these communication strategies enables you maintain a customer-first approach consistently, fostering trust and satisfaction.

Leveraging these communication strategies enables you maintain a customer-first approach consistently, fostering trust and satisfaction.

How to monitor Consumer Duty outcomes as a marketer?

Being able to measure if you are achieving good outcomes is a critical feature of the Consumer Duty, and something you are no doubt already reporting on to your stakeholders. With marketers at the ‘coalface’ of consumer Duty efforts, it’s important they take the lead with a thorough assessment of all customer-facing materials, including websites, brochures, and marketing materials, as well as the customer journey from initial contact to post-sales servicing. Some ways to do this include:

- Analyse customer engagement, acquisition, and retention figures. Look for patterns and trends that indicate whether products and services are meeting customer needs.

- Continue to review the availability of online services and the variety of channels available to customers, particularly checking on accessibility for vulnerable customers. You could use ‘Mystery Shoppers’ or personally experience the service to identify areas that need attention.

- Customer Satisfaction Scores (CSAT): Regularly collect feedback from customers to gauge their satisfaction levels. This can be done through surveys, interviews, or online review platforms.

- Likewise, monitor your Net Promoter Score (NPS) which determine the likelihood of customers recommending your business to others. A drop in NPS scores could mean declining customer loyalty and advocacy, and identify areas you need to remedy.

- Collaborate with your customer service leaders to view complaints and resolution times. Have these decreased now that CD has been implemented? Are there less queries as your communications have (hopefully!) become more transparent?

Final thoughts

Ensuring good customer outcomes will be something that should already built into your core values as a marketer, and you’ll know that it’s a continual process embedded into your team’s daily operations, (with the help of tools like our checklist and monitoring tips).

It’s not about meeting minimum requirements; it’s about weaving great customer outcomes into every corner of your business. When you genuinely prioritise your customers – in how you communicate, serve, and support them – you’re not just following regulations. You’re rebuilding trust in the industry, creating an attractive workplace, and setting your business up for long-term success.

If you have questions about implementing Consumer Duty strategies into your campaigns or reviewing your comms, get in touch with Moreish for a chat. Or, for more on this topic, you can listen to Simon speaking with Stuart Wilson at The Later Life Lending Symposium 2023 here.