Ahh, trust. Good old trust. A brand’s most fickle best friend. It takes years to build up, as little as a single encounter to dash down.

Arguably, trust is more important in the financial services sector than some others, especially since there is a severe lack of, and you’re rarely buying anything of immediate tangible benefit. It’s become a central debate in how financial services can move forward.

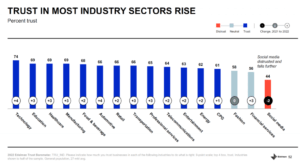

The latest 2022 Edelman Trust Barometer report shows a more positive note than previous years, with public trust in financial services increasing 3% from the previous year.

The bad news? Financial services ranked second to last place, with a 56% trust rating.

There’s clearly still some way to go.

There are ways that we can approach financial services marketing to help the road to recovery and restore trust.

Mostly, it’s actually pretty simple.

1. Ditch the jargon

Always, always, always, go out of your way to craft simple, easy to understand copy in financial services marketing content. When trust in the industry is low, don’t give your audience the impression that you’re hiding behind jargon. And that goes for small print and T&Cs as wells as headline and body copy.

Your average reader doesn’t work on Wall Street, isn’t a hedge fund manager, and finds the DOW’s rapid ups and downs maddening. To make it relatable, tie your financial message into an experience your readers do know intimately.”

Chris Schafer, Content Marketing Manager at Brandpoint

Create an internal process that allows you to run all first drafts of copy through the “simple police” in the corner. And no, this isn’t handing it to compliance at the end. What we’re talking about here is changing your frame of mind before you even start to create content. Nothing should go to a second draft unless it’s passed the jargon filter.

In our experience of working with Financial Services marketing departments, if you can’t explain it with simple language, then a) the concept or product isn’t simple enough, or b) there’s not clarity internally. In which case you shouldn’t be looking to market it externally yet.

And even when it comes to adviser-facing content, you’re still talking to a human being. By all means use jargon where appropriate, but leave it at that. Don’t be that annoying person round the dinner table that uses big word to try and make himself sound clever, rather than just saying something clever in the first place.

2. Educate and add value

What better way is there to build trust than to teach? Educational content is great. Give your customers the tools and resources to inform themselves about the market and your products. This will help them to feel empowered about the buying decisions they are making.

Interestingly, 55% of respondents to a NewsCred survey said that they trust a bank more when it offers them helpful, useful content.

3. Work with compliance

Ultimately, compliance exists to protect the best interests of the consumer. Take a leaf out of their book and champion the customer in all of your marketing.

When it comes to compliance, it’s not ‘them vs us’. Don’t see them as the sober party pooper popping all of the balloon in the corner of the room.

Involve them in your marketing campaigns from the very beginning. ‘Passing compliance’ shouldn’t be an afterthought. You might be surprised at the value this adds – they’re seeking the same clarity and honesty that your customers are.

Here’s some advice from Mark White, CMO of Raymond James Investment Services:

Especially in our industry, it’s really important to be compliant. We have a small compliance group that physically sits in marketing, so it’s an integrated part of the process. There are various steps when we are going through the planning process or production process where they can flag things to say: “That’s a topic that may require additional review.”

I know in some places you create a great piece of content and you pray that it is going to get through compliance. We don’t approach it that way. It’s integrated from the beginning.”

4. Focus on customer service

These days consumers do their research – they shop around online, read reviews, visit comparison sites, ask friends and family. On top of – or instead of – seeking professional financial advice.

You won’t escape online reviews in one way or another, even if you hide under the bed with your eyes closed and your fingers in your ears. Find a way to embrace it. Encourage your customers to review you. Direct them towards positive testimonials. If you’re lucky enough to have a 5* Defaqto rating for example, shout about it.

5. Focus on your customers as individuals

Always revolve your marketing around what matters to them in their world. Every single word should aim to connect with them as individuals.

Why? Because at the heart of it, money is a high emotive, individual topic of conversation, inextricably linked to your customer’s hopes, fears, dreams and future.

Create rapport with your audience and demonstrate that you understand their interests. As Jenko Kent, Chief Creative Officer of Stage 6 Media puts it –

Money is a fundamentally emotional issue for the average person, and we make ourselves vulnerable to the companies who we trust enough to bring into our financial worlds. If instead of lauding your facts, figures, success rates, and service offerings, you can connect with your customers on a human level, you’re going to have a much more substantial impact.

The best way to do this is by telling heartfelt stories that demonstrate your genuine passion and determination to care for your customers.”