Standard Life Home Finance Calculators

The Challenge

Standard Life Home Finance launched into the equity release market, offering a range of equity release plans, with flexible lending features.

Our goal was to develop a full range of comprehensive tools to support advisers to instantly showed Standard Life Home Finance’s credibility in the market.

Moreish Approach

We worked closely with the client to develop a range of engaging and interactive B2B and B2C calculators, outlined below.

B2C calculators

We developed the user journey and design of two simple calculators, and supplied these to the client for build:

Equity Release calculator

By entering a few simple details, the client can find out how much they could borrow based on their age and value of their home. Results also highlighted the flexibility and competitive rates that Standard Life Home Finance equity release plans offered, along with a quick book an appointment form to encourage consumers to get in touch.

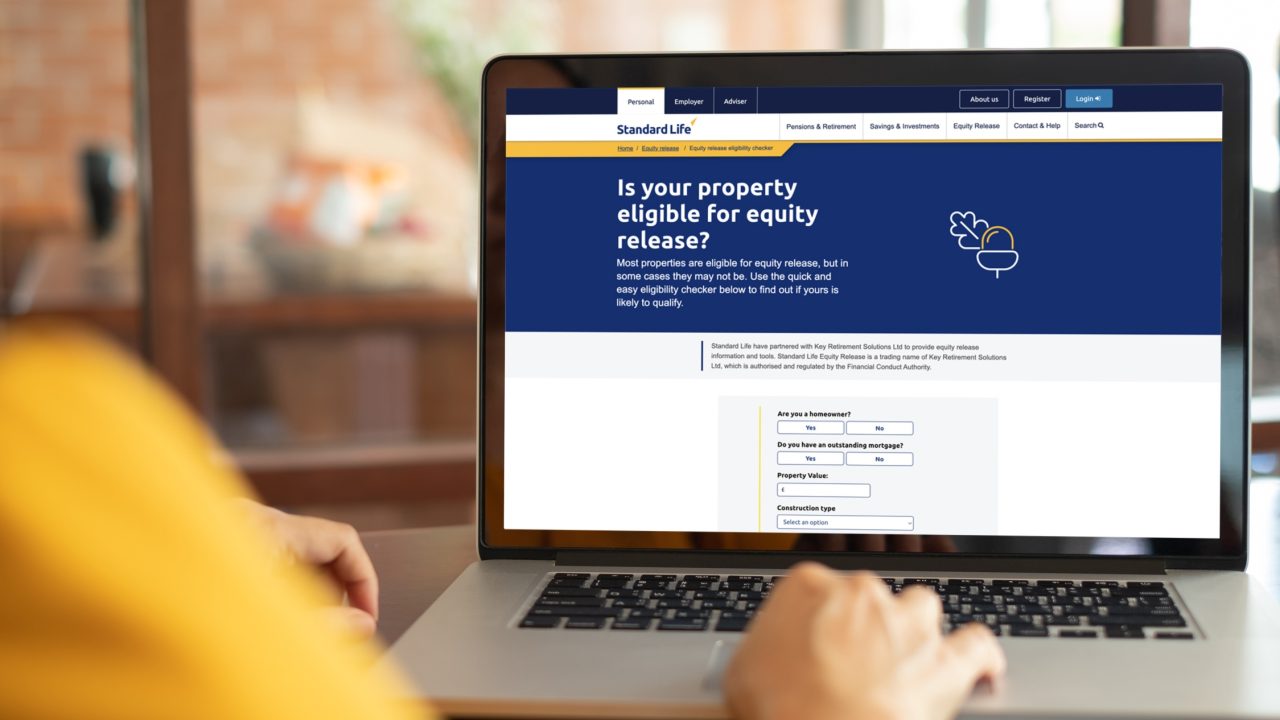

Property Eligibility tool

In connection to the Equity Release calculator, we also developed a tool that could help a client find out if their property could be eligible for equity release based on a few simple details.

B2B calculators

Using existing calculators on the market as a base, we developed the design and build of three tools that could support advisers in client equity release conversations, including:

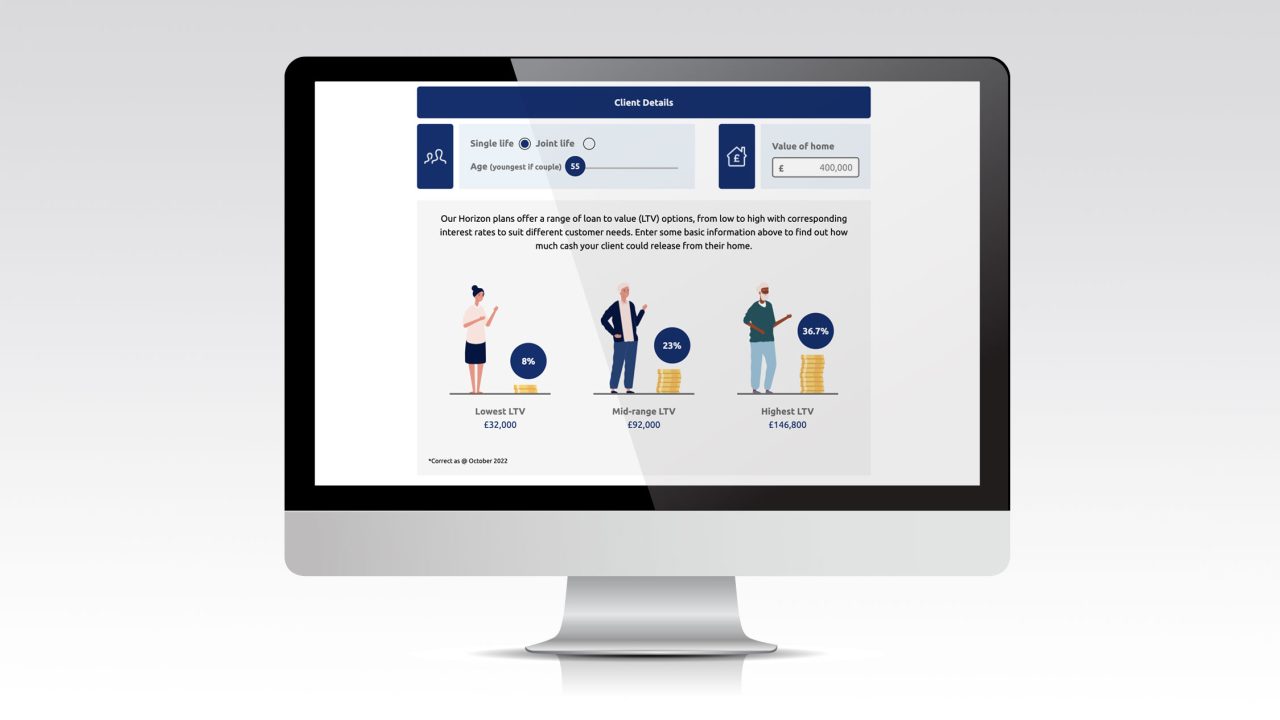

Loan to Value Calculator

The Loan-To-Value tool calculates the amount of equity a client can release from their home based on their age, property value, and size of loan required.

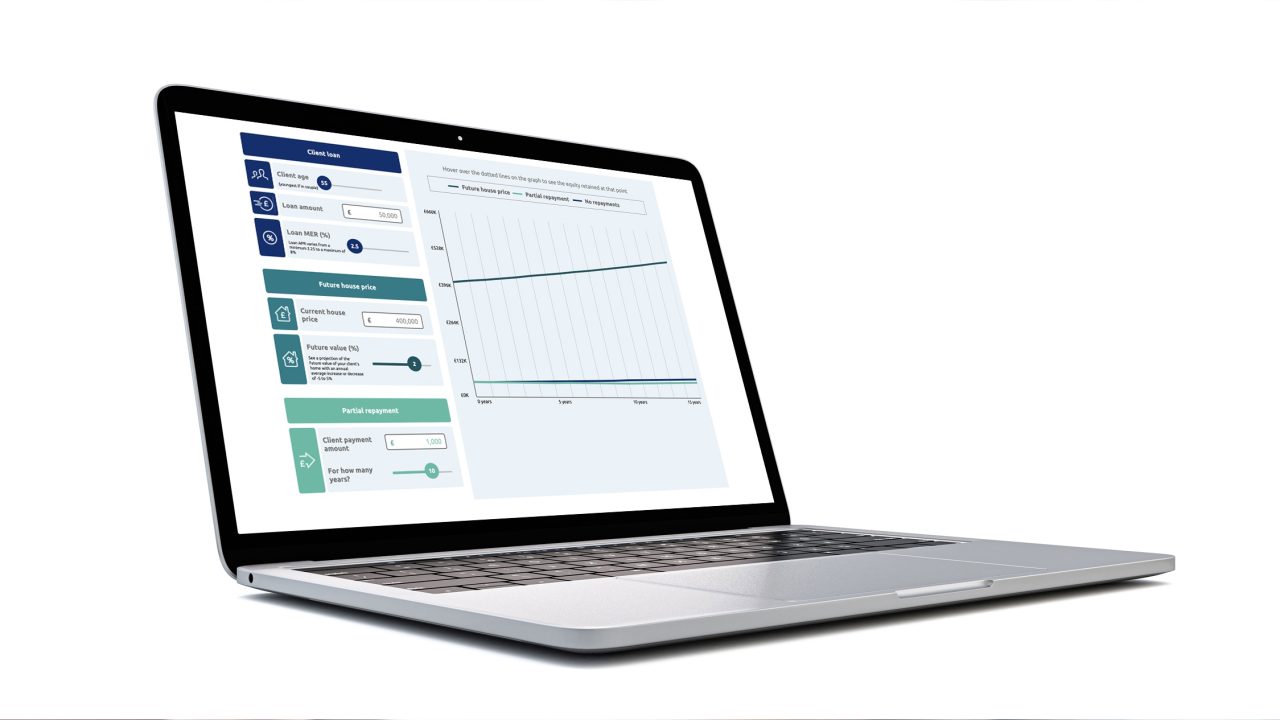

Partial Repayment Calculator

The partial repayments calculator demonstrates the impact that making flexible, optional repayments, will have on the future equity left in the customer’s home.

Inheritance Protection Calculator

The myth of not being able to leave behind anything for their loved ones is a client’s biggest barrier to equity release. The Inheritance Protection calculator works out how much equity in their home a client can protect as inheritance for their loved ones.

Results

Watch this space!

Sectors

Services

© 2024 Moreish Marketing