Openwork Protection Sales Tool

The Challenge

Having seen the success our Risk Reality calculator for LV=, Openwork contacted Moreish to see how we could help enhance their marketing to increase Income Protection sales as a % of adviser’s overall protection sales.

Moreish Approach

As one of the largest financial advice networks in the UK with over 3,600 advisers across the group, we were very aware of how small changes to their sales systems and process could have big impact on sales.

So we provided digital and design consultancy on how best to integrate the intelligence of our Risk Reality Calculator into their mortgage application portal.

We recommended using personal details entered into the customer mortgage application process to automatically produce a personalised protection report that had to be shared and discussed with clients before any mortgage application could proceed.

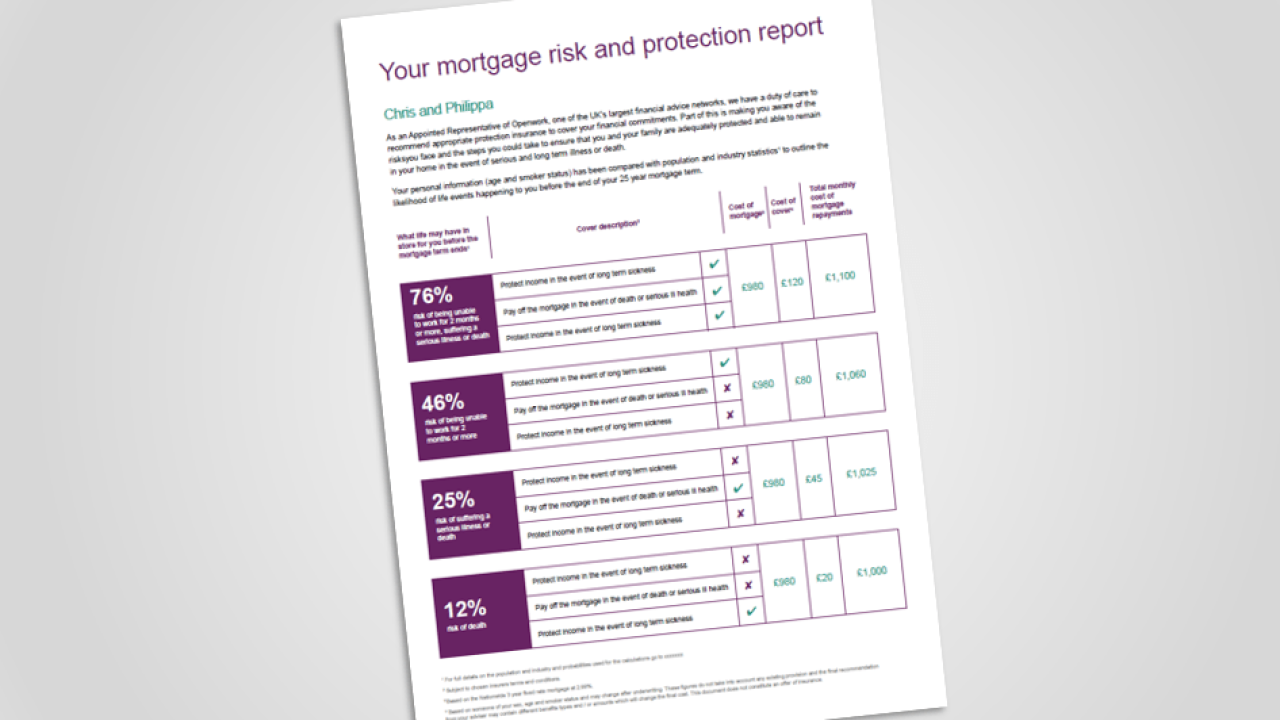

The report, illustrated above, provided personalised information on the likelihood of them:

- being unable to work for two months or more

- suffering a serious illness

- or dying

before their chosen mortgage end date – and the indicative costs for them to protect against those risks.

The simple output prompted advisers to discuss all the risks, rather than simply recommending Critical Illness and Life Cover. It also enabled clients to instantly grasp the importance of protection and the costs involved to deliver a more engaged sales process. Try the Openwork Risk Reality Calculator.

Moreish Results

The result was astonishing. This small but seamless addition into the adviser sales screen led to an instant 25% average uplift in Income Protection sales across their 3,600 adviser base! See this article on FT Adviser for full details.

If you’re looking for a digital marketing agency for financial services, get in touch with us here.

Sectors

Services

© 2024 Moreish Marketing