more2life Equity Release tools

The challenge

more2life, a leading provider of equity release plans, faced the challenge of effectively promoting their unique offerings, streamlining information for financial advisers and enhancing the sales journey. Our challenge was to develop tools that would simplify the equity release process, provide real-time information and support advisers throughout the sales process.

Moreish approach

We introduced three interactive, cutting-edge tools to help financial advisers demonstrate the benefits to their clients:

Max LTV tool

Working in collaboration with more2life, we developed three interactive, easy-to-use tools that financial advisers use with their clients.

The Max Loan-to-Value (LTV) Tool tells clients how much they can borrow across different more2life plans. In the tool, users input key details, such as age and property value, and it calculates the potential release amount. It also alerts users if the information provided does not match the eligibility criteria. And a call-to-action (CTA) leads users to the portal for further steps.

The tool’s versatility is enhanced by its backend, allowing the team to make updates easily, such as to LTV rates, plans and market changes.

Lending Criteria Tool

Lending Criteria Tool

The Lending Criteria Tool can be used in two ways:

- Quick Check: When advisers want to know if more2life accept certain criteria across their range of plans, this provides a quick overview of each plan’s criteria

- The Specific House: If advisers know more specific details of the property, the specific house tool shows them what plans their client is eligible for.

Based on the selected criteria, advisers are asked specific questions for a clearer assessment and, based on the answers to the questions, they are shown what plans their clients are, are not and may be eligible for – and why. They can click “Show Eligibility” to see their results, although there might be cases where a team call is needed for confirmation.

Like the LTV tool, more2life have a backend if they want to make edits to the criteria (especially in an ever-changing market), which they can do so with ease and requiring no coding or development.

Retained Equity and Repayments Calculator

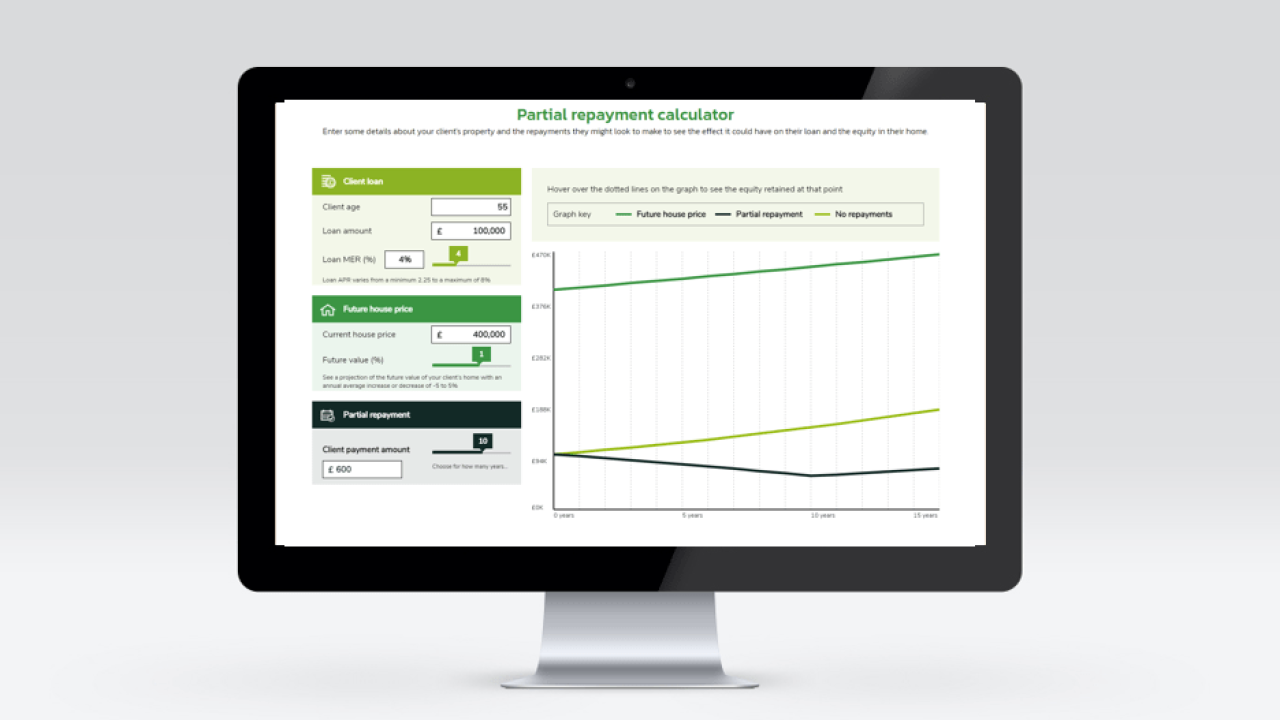

Addressing the complexity of retained equity and repayments, this calculator empowers users to assess how equity evolves over time. It shows scenarios where interest accumulates and repayment options are chosen. Even if repayments are made, the assurance that the owed amount will never exceed the property value is a key highlight.

Users input details through a user-friendly interface, and results are presented in a graphical format. The graph visually represents the house value’s progression, repayments and the difference in retained equity over time.

We also provided a local intelligence tool which allows users to explore equity release statistics by clicking on specific regions of the UK. Users can access valuable equity release research, enhancing their understanding and decision-making process

The results

The tools have been established across the industry as the go-to adviser tools for explaining these product features to clients – reinforcing more2life’s position as market leaders and innovators of the equity release market. They’ve also been really well-received by advisers, being praised particularly for their ease of use, especially given the ever-evolving nature of the industry.

Sectors

Services

© 2024 Moreish Marketing