We understand that with four chancellors in four months and Liz Truss being beaten by a lettuce, developing your Consumer Duty implementation plan may have fallen to the bottom of your priority list in recent weeks :-). But we are here to provide some last-minute guidance on what you need to do by Halloween!

As you’ll know the duty aims to establish enhanced and clearer standards across financial services, all aimed at delivering better customer outcomes. Firms will need to look across their entire business operations including products, service support and customer communications.

And no doubt your business will have been considering the scope of the implications this will have on your firm. But for many, it may have been pushed down the to-do list as a result of responding to the current crazy financial and political environment in which your firm finds itself.

So, if you’re concerned about the approaching deadline, we thought it might be useful to take a look at the deadlines and requirements.

For financial providers and advisers, the rules will affect each type of firm slightly differently, which we will explore in another blog post soon, so keep an eye out!

And before we carry on, we must say Moreish are NOT regulatory but communication experts. However, as communication is pretty fundamental here we’ve taken the trouble to summarise what we have been able to take away from the 121-page document, which hopefully may help some of you out there!

The looming deadline: 31st Oct

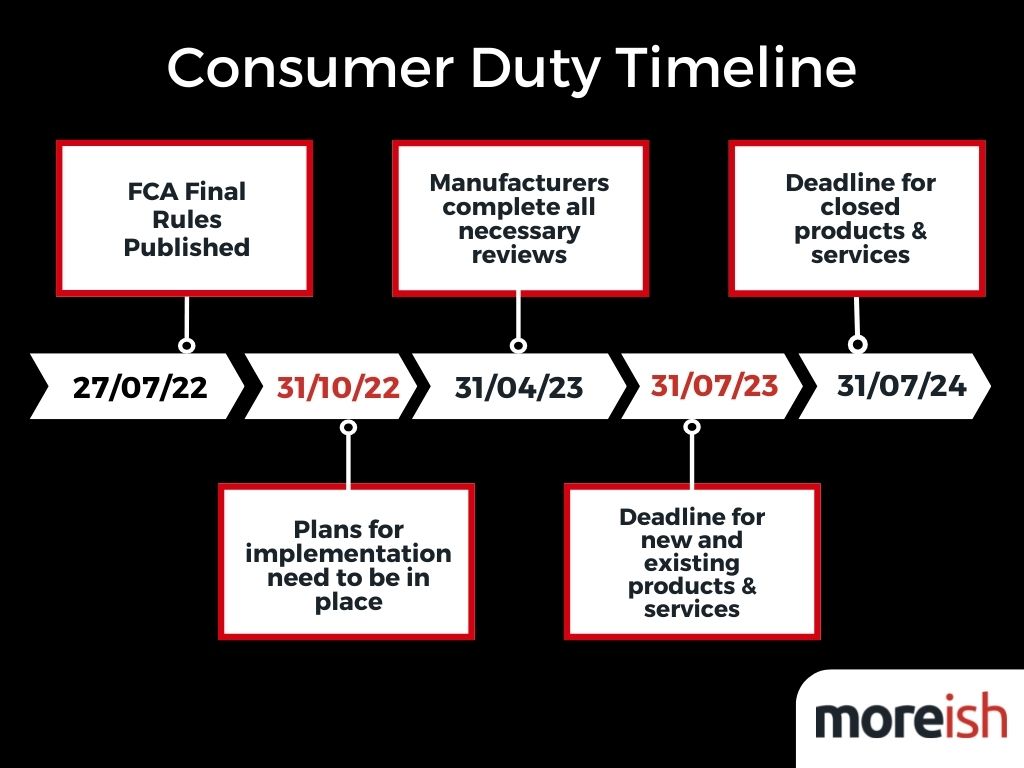

Earlier this year on the 27th of July, the final rules of the act were published by the FCA. But for now, firms need to have a high level implementation plan ready and in place for the 31st of October 2022 (not long now!). This plan doesn’t necessarily have to be entirely mapped out, but it must provide assurances to the FCA and other governing bodies that the consumer duty will be fully implemented on all new and existing products and services within the firm by July 2023. The FCA expects top company board members to play an active role in overseeing these plans, ensuring they are on track to meet the deadlines.

By the 31st of October, your business needs to have agreed its plan and be ready to be challenged to demonstrate the plan are will help enable you to meet these new standards. Alongside this high level plan. you’ll need to be ready to share your plan with the FCA along with any board papers and minutes with supervisors and be ready to be challenged on their content. Sounds obvious but make sure you have all these sorts of outputs saved somewhere centrally on your systems, if asked!

These are a few key things that we understand from our research that needs to be included in your plans:

- Identification of what products are affected

- Definition of target outcomes based on evidence from gap assessment

- Direct senior management and company framework changes that ensure responsibilities are embedded appropriately

- Changes to the governance structure, ensuring that the right information to address the outcomes flow through the organisation and is used to drive change

- Changes to support processes, procedures and customer communication planning

- Considerations for how changes will be driven, both top-down and bottom-up approaches

It is worth re-iterating that you don’t need to submit any plans anywhere, but you need to have them ready just in case you are asked to provide evidence for what your firm is doing.

Deadline two: 23rd April 2023

After this, manufacturers will have until the 23rd of April 2023 to complete reviews on all their existing open products and services to ensure they comply with the new duty.

Manufacturers must then share the information required by distributors to fulfil their own obligations under the new duty.

Deadline three: 31st July 2023

3 months later on the 31st of July, all implementation changes to new and existing products or services must be completed by both manufacturers and distributors as the new Duty goes live. It should also be noted that businesses must also notify the FCA if they believe they will be unable to complete all compliance work by these deadlines.

Deadline four: 31st July 2024

One year later on the 31st of July 2024, all necessary changes on closed products and services should be fully implemented across all businesses.

Final words with sympathy (and much positivity) …

If you’re reading this Consumer Duty may be causing you a bit of a headache already. But on a more positive note, firms that do get this right will massively enhance their customer relationships and brand values – both of which are key to long term growth.

We will be producing more content around consumer duty to help in the coming weeks and months, focusing on:

- Humanising the Consumer Duty… because someone has to!

- The Implications for Advisers vs Providers

- The Element of Design in Consumer Duty

And much more…. but please let us know your thoughts on any content that you would like to see from us!

And please keep in mind as a strategic and creative specialist FS communications agency, we might be able to help in a couple of ways. We’ll help you put a customer hat on to deliver better customer outcomes (our whole ethos is built on this). In phase 2 we can help you enhance and pressure test your communication plans with a consumer lens. And from phase 3 onwards we’d love to get our hands dirty on all those old stuffy mandatory comms and bring them to life with a less is more approach to copy and fresh design that informs and guides your customers to better outcomes.

That’s it for now. And good luck!