OneFamily customer retention post CTF/JISA maturity

The Challenge

With 100,000s of OneFamily Child Trust Funds/Junior ISAs maturing at the end of 2022, customer retention became the brand’s #1 priority.

With the responsibility of savings moving from parents to their kids (literally overnight when they reach 18!), we were tasked with helping OneFamily build strong relationships – that would help the 18yr old audience through this transition and for all of life’s financial journeys to come.

The Moreish Approach

Stage 1: Pre-maturity communication to parents

We developed a number of DMs and emails to encourage the parents to pass on control to their children by setting them up as the registered contact before maturity. Through this communication, we helped them understand the transition as well as options available to their children post maturity.

Stage 2: Pre-maturity communication to teens

Once the teens were set up as the registered contact of their account, we developed multiple content pieces and emails to educate the teens on who OneFamily are and what they can do with the money once they have access to it:

- Who OneFamily are and how we’ve been looking after their money ‘behind the scenes’

- A personal note from the CEO on how having them as a part of our family is so important to him

- How they can support their movement on climate change by investing with OneFamily

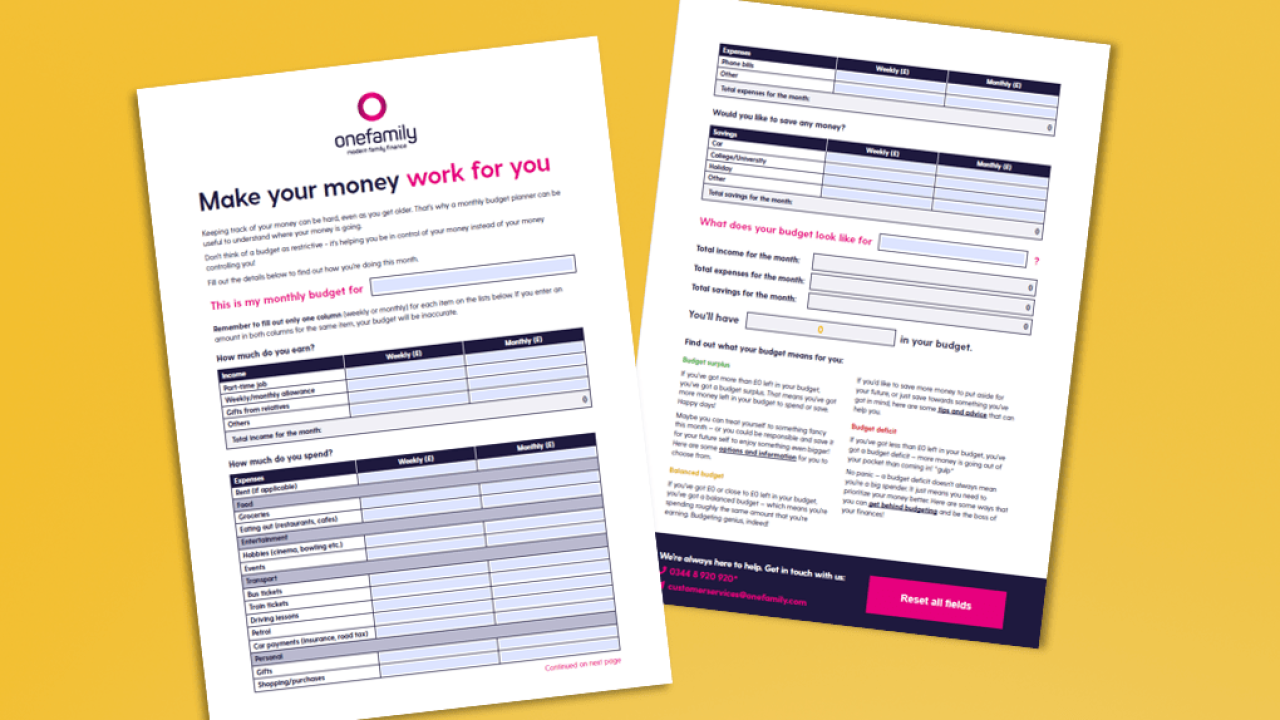

- Interactive budget planner template to help teens understand the concept of budgeting

Stage 3: Post-maturity onboarding for teens

Aimed at matured CTF teens who signed up for an ISA or Lifetime ISA, we developed a number of onboarding emails to help them get set up on their new account.

Moreish Results

We’re awaiting commercial results of this family finance initiative, so watch this space!

Sectors

© 2024 Moreish Marketing